The Asia Pacific region has become a prolific producer of and strong magnet for talent, and this has significantly increased the size and diversity of the talent pool. On one hand, the number of experienced local Asian executives continues to grow, driven by

an increase in educational and training opportunities for professionals in the region, an expansion in the number of Asians returning from overseas study or work-abroad assignments, and the growing mobility of Asian executives within Asia. The region

also is drawing more Western executives, many viewing Asia experience as critical to their career advancement and others regarding the region as a source of long-term opportunity, particularly in light of continued economic uncertainty in the West.

The expansion in the size and diversity of the Asia talent pool represents a double-edged sword for companies recruiting in the region: while organizations have more options, the complexity of the talent pool makes it more challenging to find and evaluate the candidates who would be the best fit for specific roles.

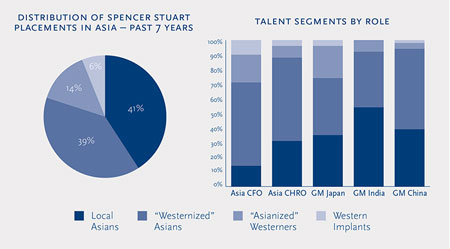

With this complexity as a backdrop, Spencer Stuart examined the pattern of our placements in the region to see what trends they might reveal. We analyzed placement details of about 1,500 senior-level placements made by Spencer Stuart over a seven-year period. Placements covered all key industries across 18 countries (excluding Australia and New Zealand) between 2006 and 2012. Drawing on our findings, we have a three-fold objective with this study:

- Tame the complexity of the talent landscape with a framework for identifying and understanding the various talent segments

- Embrace this complexity by elucidating the region’s key talent trends

- Capitalize on this complexity through a set of pragmatic and actionable recommendations

Taming the complexity: Understand the sources of talent

To help bring structure and clarity to the complexity of the talent pool in Asia, we segmented our placements in the region along two dimensions: individuals’ region of origin, which could be either Asia or the West, and the depth of their experience outside their region of origin. Four mutually exclusive talent pools naturally arose from this segmentation:

Local Asians: Executives who were born and bred in Asia and have not lived for any significant period of time outside of the region.

They have local language skills and sensitivity as well as strong local ties and relationships, but may lack global experience or exposure to Western multinationals, although this is quickly changing.

“Westernized” Asians: Executives from within the Asia region who have studied and/or lived for a significant time period outside of Asia.

These individuals have both local knowledge and language skills and familiarity with Western business practices. This talent can be hard to attract and retain.

“Asianized” Westerners: Executives who were born in the West but have strong Asia credentials, having

worked in the region for a significant period.

When these executives call Asia home, they typically have local sensitivity and relationships and may speak one or more Asian languages, while also being able to relate to headquarters in the West.

Western Implants: Executives who were born in the West and have limited experience in the region.

While relatively few of our placements in Asia fall into this category, companies in Asia will hire Western Implants when they bring a unique business experience not found in any of the other

three talent pools, often at the CEO level.

Embracing the complexity: Five talent trends to watch

Our analysis reveals five key talent trends.

1. Asian talent has become increasingly sought-after, versatile and diverse.

Asians account for 80 percent of all of our placements; most of these are split about evenly between Local Asians and Westernized Asians. No single country of origin dominated the

placements: executives from Mainland China, Japan, India, Hong Kong and Singapore all figure prominently, and none of these account for more than about 20 percent of the total number of

placements.

Even when Western placements are added to the mix, “Asia relevance” is a must for most roles. When companies have hired an executive without experience in the region, the lack of Asia

experience was trumped by some overriding factor that made the individual unique, particularly for CEO positions. For example, these executives typically bring specific industry and/or

functional experience, such as the combination of business transformation expertise in a specific industry and experience working with financially focused investors.

2. However, Western executives continue to dominate the top roles of Asia or global CEO, likely because they are still the most “versatile.”

Despite the dominance of Asian talent across Spencer Stuart placements in Asia, Westerners are still critical for filling CEO-type roles in the region, particularly at MNCs, with 40 percent more Westerners placed in CEO-type roles than in regional function head or country head roles. We believe that this can be explained

by the concept of executive “versatility” — a function of the ratio of the talent pool placed outside of their country of origin and the number of distinct countries across which they were placed.

Today, executives from Singapore, Hong Kong and India generally are seen as more versatile than their Japanese and Chinese counterparts. However, Western talent is still seen as being significantly more versatile, likely explaining why they still dominate the CEO-type roles.

3. Mainland China is an important and growing source of executive talent for the region.

Mainland China is poised to be an even more important source of executive talent for the region as the size and experience levels of this pool continue to increase. This is occurring for several reasons. First, the number of educational

and training opportunities for professionals in the region — and particularly in China — is growing, including the growth in development programs at multinational companies that have

been adapted to identify, groom and develop Asian talent. Meanwhile, a new breed of top Asian companies, including Huawei, Lenovo and Haier, are aggressively investing in talent management. Huawei, for example, has a 155,000-square-meter

corporate university in Shenzhen with state-of-art training complexes, residential units and recreational facilities catering to the training and development of junior and senior executives from

around the world. The number of Chinese studying and gaining work experience abroad continues to grow, and unlike the first wave of Chinese students studying abroad who tended to remain

in the West, many are now choosing to return to China. According a report authored by the Chinese Services Centre for Scholarly Exchange (CSCSE), the number of returnees was 186,200 for 2011, about 40 percent more than a year earlier. The report

also estimates that since the 1970s more than 72 percent of Chinese students have returned to China after completing their education abroad.

4. A growing number of Asian executives, especially Mainland Chinese, will likely move into the top regional and global roles.

Although there is still a relative scarcity of Asian executives playing top regional and global roles, particularly at MNCs, this situation, especially for Chinese talent, could change dramatically

in the next five to 15 years. Aside from lower versatility, the current lack of Chinese talent serving in top regional and global positions has been driven by 1) the current thin bench of Chinese talent with significant management experience, 2) the runaway growth of China, which has required virtually all available Chinese

talent for China, and 3) the fact that the country opened up to Western influence and business education less than 30 years ago.

However, the demographic, cultural and commercial rise of China will create a steady supply of Chinese executives, particularly women, in the coming years as the country’s first Western-educated leaders reach their 50s. Furthermore, as Chinese executives gain experience in broader, more regional or global roles, a growing number will have the versatility to step into senior general management positions. And as China’s economy matures and GDP growth slows to more moderate and sustainable growth rates, Chinese talent may be freed up to rotate among other geographies. Several Chinese executives have already taken on country head roles in other countries or are serving in Asia CEO-level roles.

5. Women represent a growing source of talent for certain leadership roles, but have not yet broken the glass ceiling.

Over the period of our study, 30 percent to 40 percent of placements from Hong Kong, Singapore and China were women, most often Westernized Asians. Women in India were more

likely to be placed in the most senior roles, including managing or executive directors, executive vice presidents, senior vice presidents and CXO roles. However, it has to be noted that this talent pool remains very small in absolute numbers. By comparison, the pool of female executives from Chinese-speaking Asia (Greater China and Singapore) is much larger, but they

are not moving into the most senior levels of management in the same numbers yet.

Capitalize on the complexity:

A framework for finding the right executive talent for Asia

By taming the complexities of the talent market in Asia and embracing emerging trends, companies recruiting executive talent in the region will be better positioned to find and attract the right

executives for key roles. To capitalize on these insights, we offer the following recommendations.

Segment your talent pool. To increase the effectiveness of an executive search, begin by segmenting your target population, recognizing the size and relevance of each talent segment to your search. For example, Westernized Asians

often are viewed as the “Holy Grail” of talent by Western multinationals, able to bridge East and West. However, compensation for this pool of talent is now on par with, if not higher

than for, Westerners, so there is no bargain to be made. Asianized Westerners are often the “forgotten children” of the talent market in Asia. They have deep regional experience and a

commitment to the region, but multinationals often give preference to Asian citizens when recruiting externally. The Local Asian talent pool is large but needs to be nurtured and provided

with opportunities to develop on a regional basis; short-term assignments of progressive importance outside the home country can provide this developmental experience. Finally, there will always be a small but persistent sliver of the executive population that is hired into Asia because they have a specific skill-set that is

difficult to find within the region.

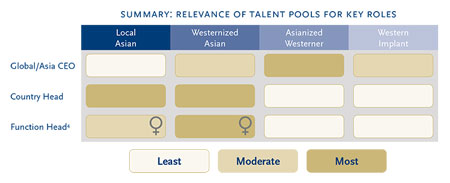

Tailor your search strategy to the specific role. Westerners with substantive experience in the region and Asians with demonstrated success across several countries beyond their

home country — those who have demonstrated leadership versatility — are most likely to be considered for global or Asia CEO positions, particularly at MNCs. Consider Western implants

for global CEO roles when deep industry or specialized functional knowledge — or a combination of both — is required. Local and

Westernized Asian talent are strong sources for country head executive positions. For functional leadership roles, focus on Asian talent, either local or Westernized.

Be strategic in identifying and attracting senior female talent. Women in Asia are gaining significant leadership experience in senior functional roles, and they will continue to grow as a source of executive talent. Focus on female executives from

Greater China and Singapore, as they increasingly dominate the region. In China, where women have a 74 percent labor force participation level, according to the World Economic Forum, they

are entering professional roles in great numbers across several industries. Moreover, a survey conducted recently by Grant Thornton suggests that women account for about 50 percent of

senior management in China, significantly more than that in other parts of Asia and even the West. An executive leading a diversity initiative for a multinational life sciences company commented

to Spencer Stuart on the strength of female talent in China in her organization, “We ran a gender diversity survey and led focus groups across the Asia region. Everyone brainstormed how to get

more females into the organization, except our China team. They had too many women, and had to discuss how to attract more men!”

Don’t miss out on the rise of the Mainland Chinese talent pool. As discussed earlier, Mainland China is a large and growing source of executive talent for the region. More local Chinese who have not had the opportunity to study overseas are exposed to very strong training and development programs offered by multinational companies and have developed sophisticated skills and management styles. Many are now

moving into country manager positions and some will be well-positioned to move into pan-Asian and global CEO roles within Asia.

Conclusion

The talent pool in Asia has grown increasingly complex and dynamic in recent years, presenting both a challenge and an opportunity to businesses that are building their teams in the region. Drawing on the right insights about the sources, strengths

and development needs of the various talent pools, companies not only will be able to tame and embrace this complexity, but also capitalize on these insights to recruit and develop the talent they need today and in the future.

1. Asia CEO refers to the Asia and Pacific head of a multinational.

2. Global CEO refers to the CEO of a company globally headquartered in Asia.

3. Defined as a function of the ratio of talent from a country placed outside of country of origin and the number of distinct countries across which they were placed. For example, 9 percent of executives of Chinese origin are placed outside of China, and are spread across four countries; hence, the versatility index is 0.7*0.9 + 0.3*4 = 1.8; the 30/70 weighting reflects higher importance of placement ratio outside of home country.

4. Female Asians are especially robust sources of function head replacement.