Introduction

The UK insurance market is facing turbulent times. The impact of demographic

changes, evolving customer needs and the opportunities afforded

by digital technology are having a disruptive effect on the industry.

Combined with increasing regulatory scrutiny and financial reporting

requirements, these changes are challenging traditional insurance business

models. Many insurers are responding by modernising their internal

operations and business strategies.

This report aims to shed light on the current population of chief executives

of UK-based insurance companies and to provide insights about where

the next generation of leaders are likely to come from.1

Diversity

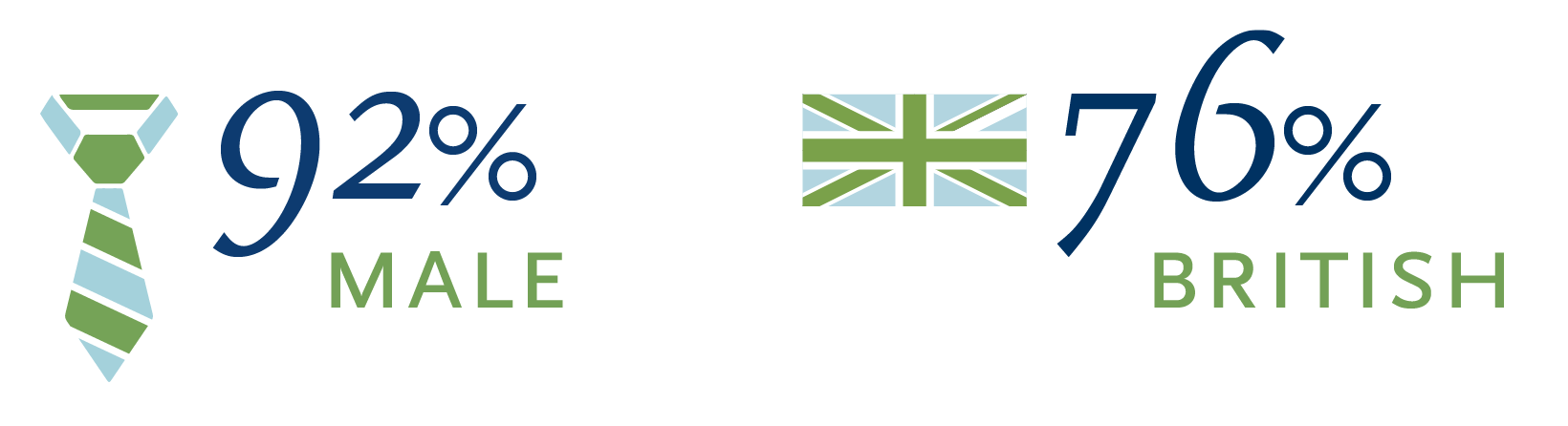

UK insurance CEOs are a strikingly homogeneous group. The overwhelming majority

(92%) are men and there is very little ethnic diversity at senior leadership level in the

industry. The average age of CEOs is 53 years.

Current CEOs are predominantly UK citizens (76%), with a handful of other nationalities

in the mix, including South Africa (3 CEOs), USA, France, New Zealand, Ireland (2 each),

Greece, India and Spain (1 each).

Education and qualifications

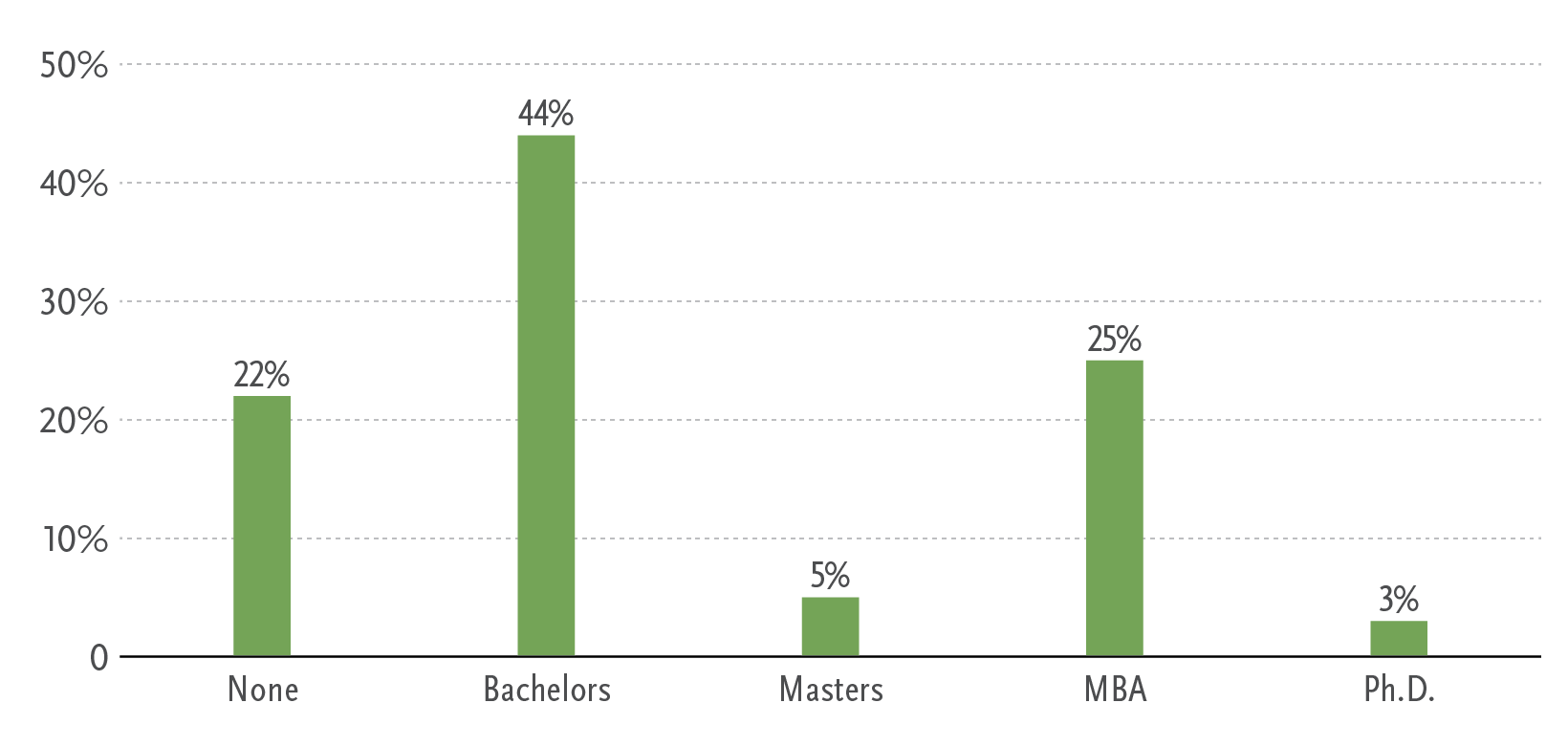

The academic backgrounds of insurance CEOs vary widely. Whereas the majority of CEOs

(78%) have a bachelor’s degree, only a quarter have an MBA. 22% of CEOs do not have

any higher education degree.

Educational background: highest degree earned

Further investigation into their career trajectories reveals that 13 current CEOs started

working in the insurance industry straight from school and obtained diploma qualifications

in actuarial science while in employment. These executives have stayed within the

sector for the majority of their careers, with an average of 20 years of insurance experience.

This pattern is only found among male executives; all female CEOs have either a

minimum of a bachelor’s degrees and four out of the five female CEOs have worked

outside the insurance sector at some point in their careers.

International experience

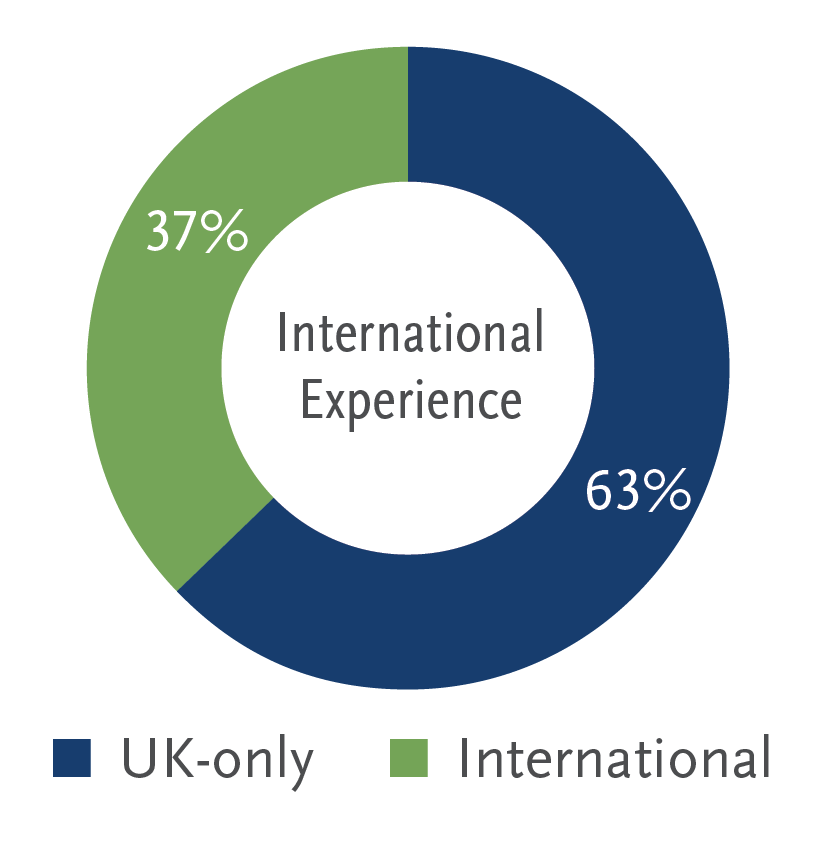

63% of current CEOs have spent their entire careers inside the United Kingdom during

their careers. Of the 37% of CEOs with international experience, the most common countries

in which they gained that experience were US (5), Australia (2), New Zealand (2),

Japan (2), Singapore (2), South Africa (2), Switzerland (2), and France, Germany, Spain, the

Netherlands, India (one each). On average, these executives spent 11 years outside the UK.

International experience

Previous experience

CEOs have an average of 29 years’ experience in professional life, of which 19 years have

been spent in the insurance industry. 75% of CEOs had experience of the insurance

industry prior to their appointment. 25% of CEOs were new to the industry at the time of

their appointment. CEOs have worked for three other companies on average prior to their

appointment, although 7% of CEOs have been at the same organisation since the start of

their careers.

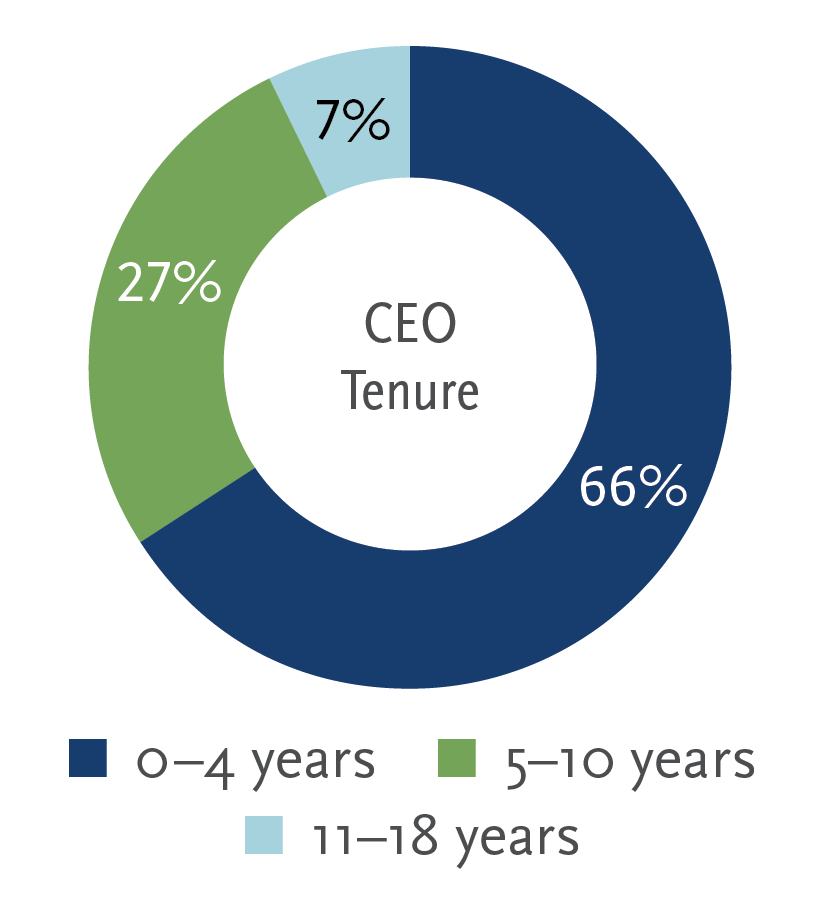

The average tenure of CEOs in the UK insurance industry is 4.2 years. By contrast, the

average tenure of CEOs running the top 150 FTSE companies is 5.5 years.2

Current CEO tenure

Internal appointments

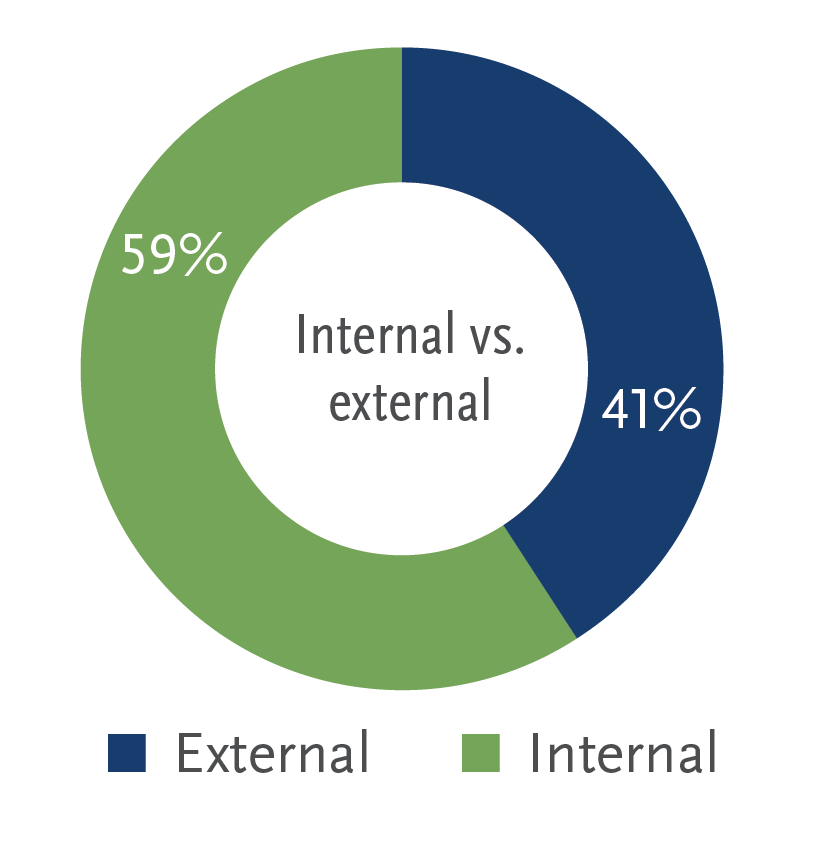

One of the most compelling findings shows that 59% of current CEOs were promoted

from inside their respective organisations — a higher proportion of internal appointments

than is found among FTSE 350 companies. Internal appointments are more

common in large multinational insurance companies, which tend to offer executives

more development opportunities including exposure to different markets and business

units; this in turn results in a broader pool of internal candidates for the role of CEO.

Internal vs external appointments

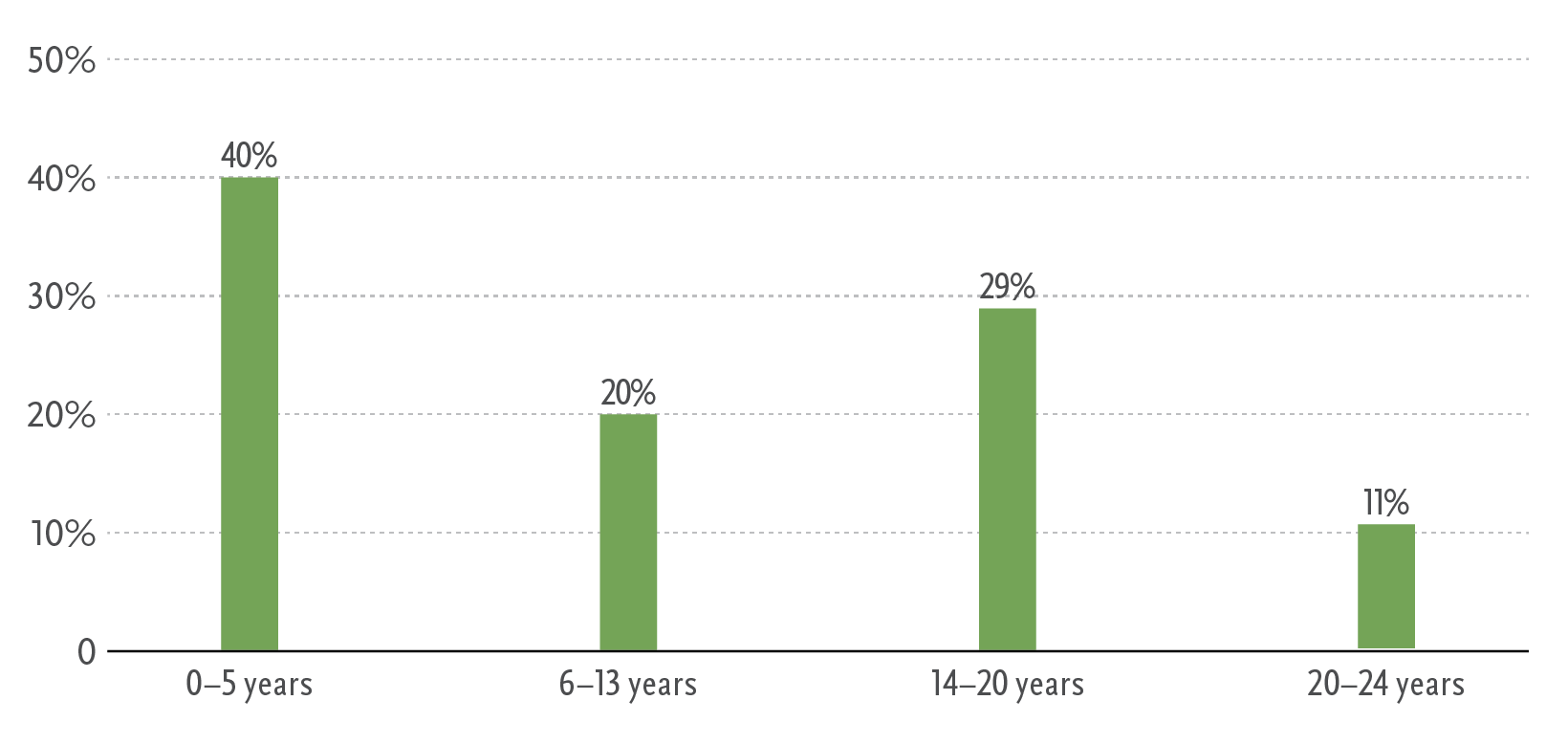

Insider CEOs spent an average of 10 years at the company before their appointment to

the top job. As mentioned above, 7% of CEOs have been employed by the same insurance

group since the beginning of their careers which have spanned 29 years on average.

Tenure at the company before CEO appointment

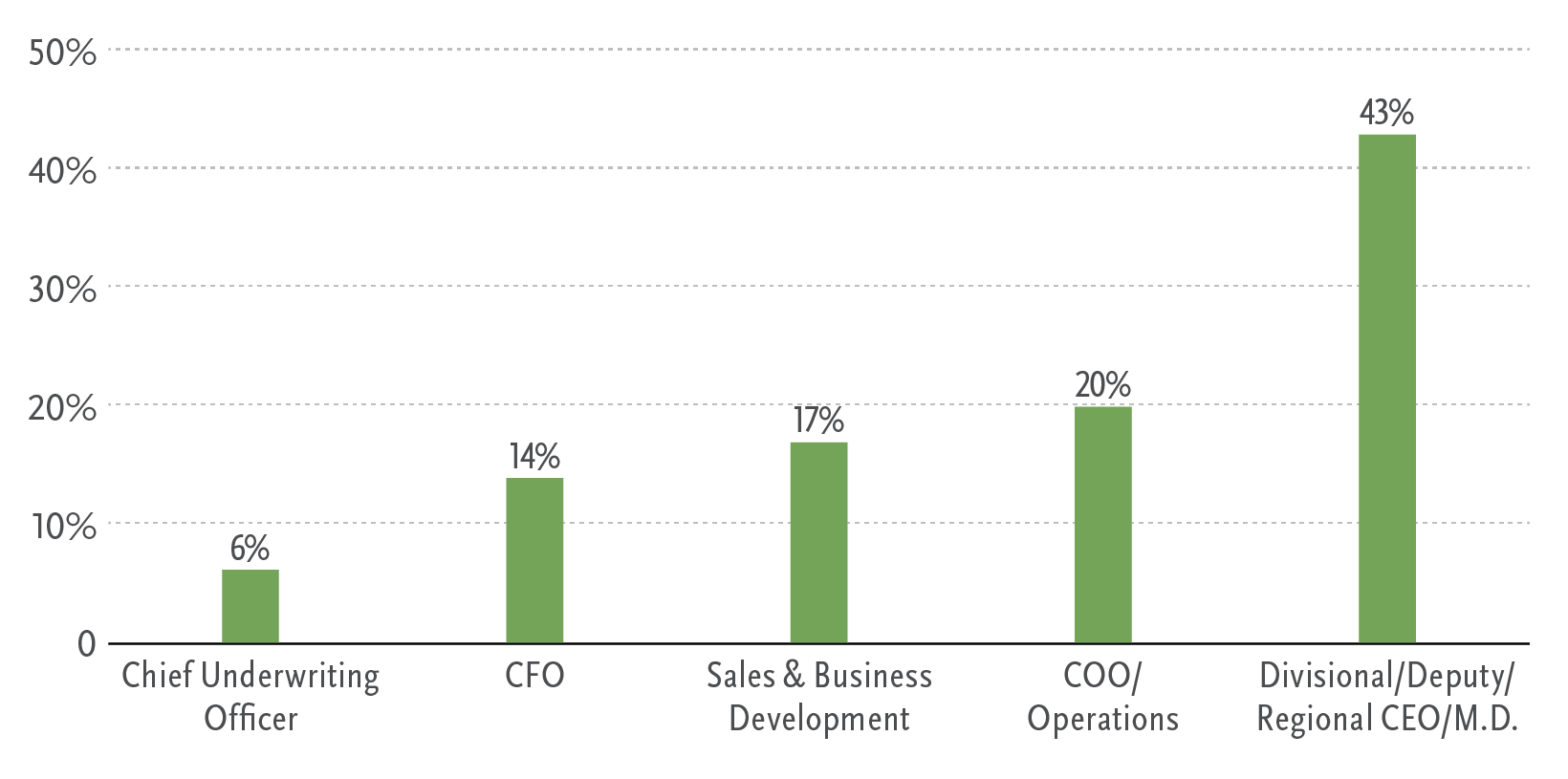

Before assuming full responsibility for group or UK-based activities, organisation internally

promoted executives had been in some kind of general management role with

regional or divisional responsibility.

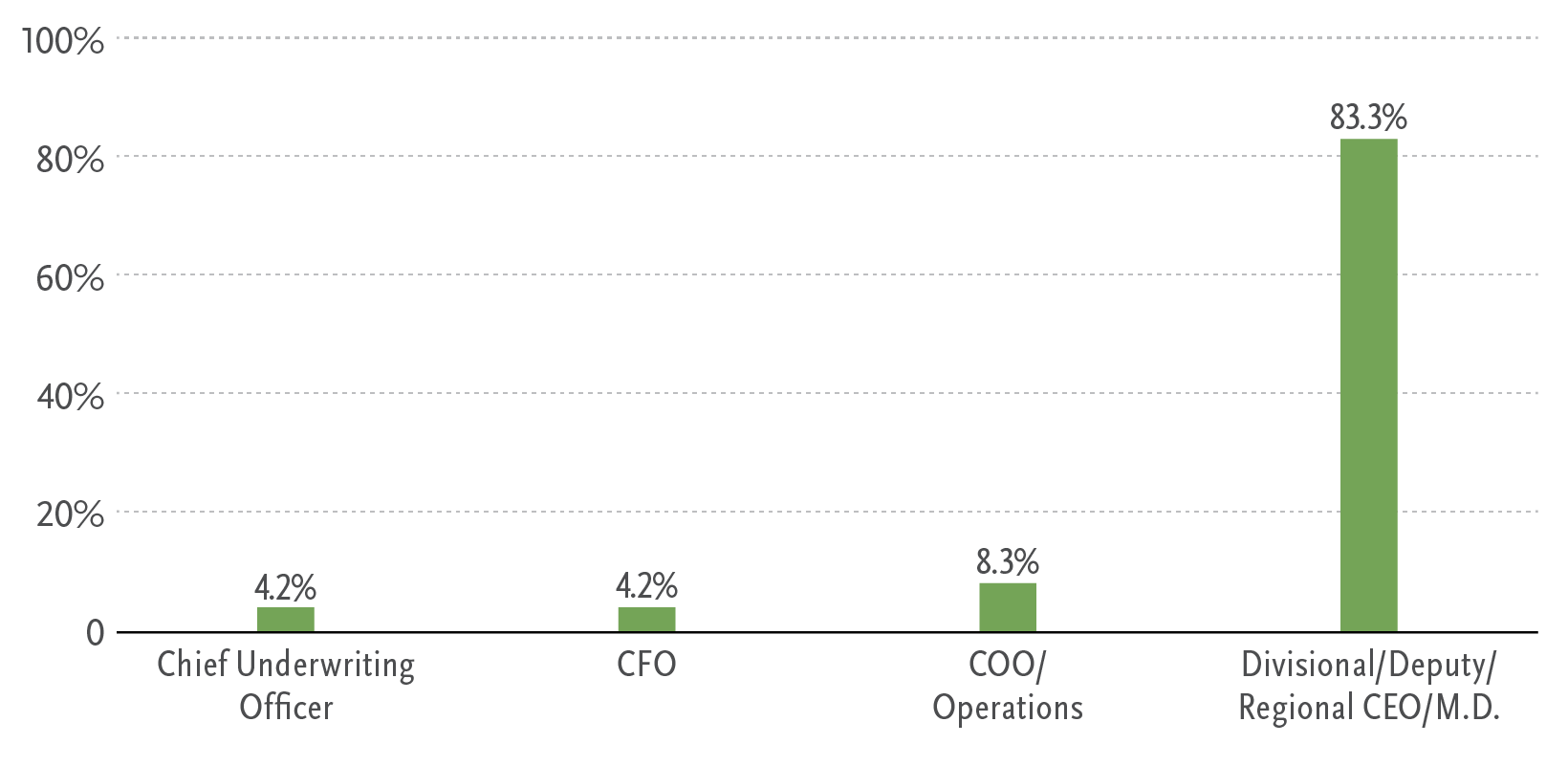

Role held prior to appointment as CEO

Other C-suite roles have also been stepping stones to the CEO job, most commonly COO

(in seven cases) and CFO (in five cases). Six CEOs in the cohort had been responsible for

a combination of retail insurance, sales and business development. Only two CEOs had

previously served as a chief underwriting officer.

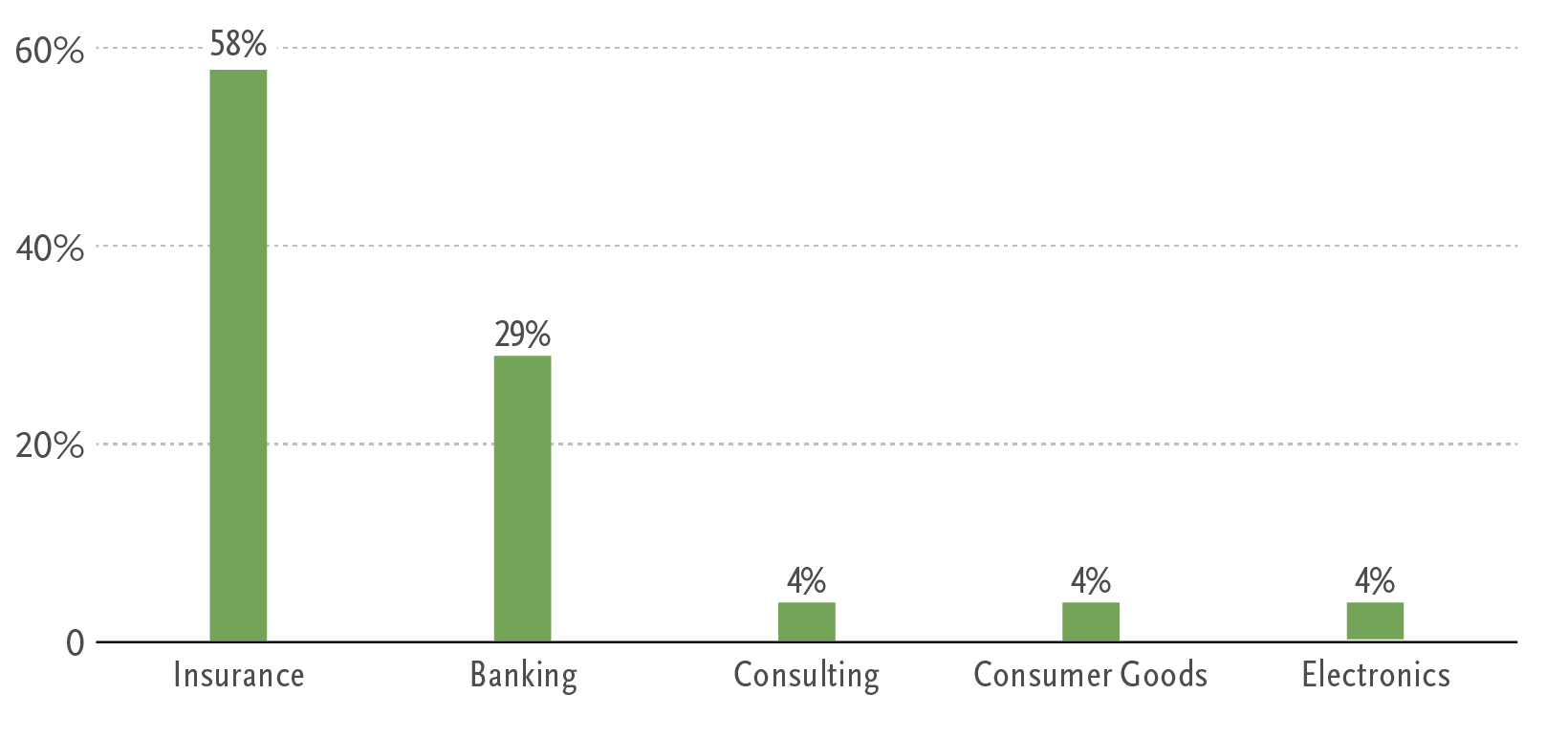

External appointments

Of the 41% of CEOs who were external appointments, 58% came from other insurance

firms. Other industry backgrounds prior to appointment included banking (29%),

consulting (4%), consumer goods (4%) and retail electronics (4%). As with the internally

promoted executives, the vast majority of externally appointed CEOs had previously held

general management roles within other organisations.

External appointment — previous industry

External appointment — previous function

Creating the right corporate culture

Culture is a critical success factor in the insurance

industry. We believe it is just as important as

strategy and that leaders should be spending their

time rigorously managing their culture. When you

align culture to strategy you get good results.

Culture is the tacit social order of an organisation:

it shapes attitudes and behaviours in wideranging

and durable ways. Cultural norms define

what is encouraged, discouraged, accepted or

rejected within a group. Culture can be challenging

to manage because much of it is

anchored in unspoken behaviours, mindsets and

social patterns.

Culture and leadership are inextricably linked.

Indeed, leaders can shape culture through their

conscious and unconscious actions. However,

before they can bring about cultural change they

must first become aware of the culture that

operates in their organisations and map the

specific effects of their culture on people and

performance.

There are two key dimensions to understanding a

company’s culture: people interactions and

response to change.

People interactions

How independently or interdependently do

people like to work? Does the organisation place

greater value on autonomy and competition or

does it emphasise managing relationships and

group effort?

Response to change

Does the organisation emphasise stability,

consistency and predictability or flexibility, adaptability

and receptiveness to change?

Spencer Stuart has developed a culture

alignment framework that describes eight

primary and universal styles that shape all

social and cultural behaviour. Each style

represents a distinct and valid way to view

the world, solve problems and be

successful, both as individuals and as

organisations. While no single style can

fully depict a culture or personal style, individual

styles and organisational cultures

tend to be more heavily weighted in two to

three styles that reflect their orientation

toward people and change.

For more information on Spencer Stuart’s approach to culture, read “The Leader’s Guide to Corporate

Culture”, Harvard Business Review, January–February 2018.

The diversity challenge

Gender diversity remains a hot topic in the UK insurance sector. Today, only 8% of CEOs

are women and considerable progress will be needed if companies are to reach the 33%

target for women on leadership teams by 2020, as published in the Hampton-Alexander

Review3. There is an increasing body of research pointing to the value of gender diversity

in improving productivity and financial performance, and many initiatives have been designed to address the imbalance. Despite ongoing attention to the issue of gender

disparity in leadership, progress for women remains mixed.

Based on our work and conversations with leaders from companies that are active in promoting diversity, the most effective approaches do the following:

Signal the importance of gender diversity from the top

Evidence shows that increasing diversity requires clear and consistent support from the

CEO and senior management, and male leaders generally.

Remove unconscious bias in assessment

Women can find themselves at a disadvantage in hiring or promotions when subjective

measures such as “gravitas” are used to evaluate candidates for senior roles — like the

5’2” female executive being compared to the 6’-plus male candidate on their “presence.”

Use data, not assumptions, to evaluate culture fit

Too often, when people think about how an individual fits with a team or organisational

culture, they think in terms of similarities in backgrounds or interests — someone they

recognize based on their own experience. But “sameness” is not the same as culture fit,

and using it as a proxy for culture fit can put women at a disadvantage over time.

Provide support for women in leadership roles

Making progress on gender equality requires not just that women be placed in senior

roles, but also that they are successful in them. This includes identifying mentors or peer

mentors and encouraging women to build an intra-company network and get involved in

the broader community to ensure they gain a foothold.

Make work/life flexibility available for everyone, not just women

Ironically, well-intentioned initiatives meant to provide women with more work/life

balance and flexibility can hurt women in the long run, when they have the effect of

placing them outside the “norm”. A better approach is to think about creating a workplace

that is more flexible about how and where work is performed — for everybody.

Be bold

To truly transform the composition of a company’s workforce and leadership, organisations

have to be willing to disrupt the status quo.

Companies that want to increase the number of women in leadership roles need strong

advocacy from the CEO, an assessment approach that minimizes bias and assumptions

about culture fit, support for women hired from the outside and a willingness to take

bold actions.

Methodology

Each individual whose career we analysed is the most senior executive in the UK business. Our

research covers each individual’s career history prior to their appointment as CEO. Any additional

roles assumed thereafter are not considered in the study.

We analysed the career profiles of 59 CEOs through a combination of information in the public

domain, data from BoardEx and Spencer Stuart’s proprietary research.

Our results are based on data from 57 companies. To view the full list, please download the article.

1 Each individual whose career we analysed is the most senior executive in the UK business.

We refer throughout to CEOs, although not every UK leader has that title.

2 Source: Spencer Stuart UK Board Index 2017

3 Hampton Alexander Review: Improving gender balance in FTSE leadership, November 2017. This target applies to

the leadership teams of FSTE 350 companies.

4 At the time of writing, AXA is in the process of acquiring XL Group.