Investor focus on board performance has reached new levels

of intensity. The chairman and CEO of Vanguard, one of the largest

mutual fund companies in the world, recently sent letters to the

independent directors of its biggest holdings in which he outlined

six principles of governance. “In the past, some have mistakenly

assumed that our predominantly passive management style suggests

a passive attitude with respect to corporate governance,” he wrote,

“Nothing could be further from the truth.”

We have come to expect that kind of perspective from activist investors, who have long

been assertive about board governance and composition. Now, large institutional investors

are joining the chorus. Firms such as State Street, BlackRock and Vanguard are

calling for greater transparency about how candidly boards are addressing their own

performance and the suitability of individual directors. As the Council of Institutional

Investors sums up, disclosure about assessment “is an indication that a board is willing

to think critically about its own performance on a regular basis and tackle any weaknesses

… and can be a catalyst for ‘refreshing’ the board as new needs arise.”

Annual board assessments have become ubiquitous, but are boards truly using

them to ensure they are as effective as their shareholders expect them to be?

Some evidence suggests the answer to that question is no. For example, 39 percent of

U.S. directors in the 2015 PricewaterhouseCoopers’ Annual Corporate Directors

Survey thought that someone on their board should be replaced. The primary impediments

to replacing an underperforming director is board leadership’s discomfort in

addressing the issue and the lack of individual director assessments, previous

research has found. The best boards are holding themselves to higher standards.

Boards that are committed to improving their effectiveness use the assessment process to get at six key questions:

- How effectively do we engage with management on the company’s strategy?

- How healthy is the relationship between our CEO and board?

- What is our board succession plan?

- What is our mechanism for providing individual director feedback?

- What is our board culture and how well does it align with our strategy?

- What processes are in place for engaging with shareholders?

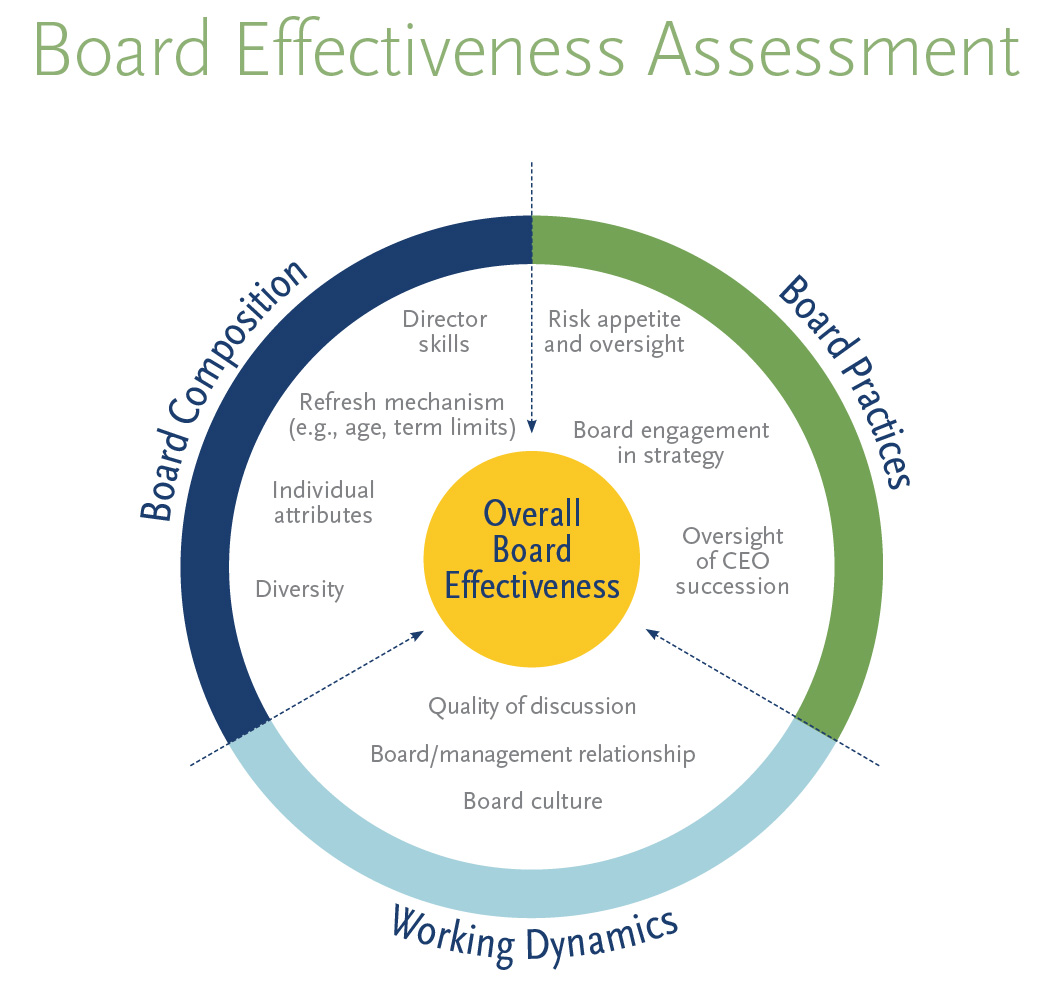

Improving board effectiveness

When done effectively, board assessments provide the

board with an opportunity to identify and remove obstacles

to better performance and to highlight what works

well. They give directors a forum to review and reinforce

appropriate board and management roles, ensure that

the board has the right perspectives around the table

and bring to light issues brewing below the surface. A

robust assessment can help ensure that the board is

well-equipped to address the issues that drive shareholder

value by focusing on the following questions.

How effectively do we engage with management on the company’s strategy?

Oversight of the business strategy always has been a

core responsibility of the board. But, today, the threats

and opportunities facing companies are more dynamic.

Digital transformation, business model shifts, the rise

of new competitors and the impact of doing business

globally require many businesses to change faster than

in the past. So, regular strategic discussions have

assumed greater urgency. The board should ensure

that the management team is responding to emerging

developments most effectively.

The CEO and his or her team “own” the strategy, but

the board provides critical oversight. Directors should

challenge assumptions and the soundness of the

strategy, fine-tuning where needed, and measure

performance against a set of agreed-upon objectives.

The best boards ensure that the articulated strategy

provides a forward-looking roadmap for the organization,

including the specific levers to improve performance.

A clear, sound strategy should serve as the

foundation for all of the board’s work, and high-performing

boards are disciplined about making sure that

it does.

The board conversation has increasingly drifted toward

reviews of historical data — compliance reviews, financial

reviews, safety reviews — that have less impact on

business results, many directors report. This backward-

looking review can come at the expense of forwardlooking

strategic matters where directors’ expertise can

be valuable in shaping future results. High-performing

boards make time to focus on what matters, striking the

right balance between important oversight responsibilities

and forward-looking conversations.

How healthy is the “balance of power” that

exists between our CEO and board?

The relationship between the board and the CEO

requires balance. The board is ultimately responsible for

selecting the CEO, reviewing his or her performance,

aligning CEO compensation with the performance of the

business, and planning for the succession of the CEO. At

the same time, the CEO is a close partner in many of

these endeavors, sometimes taking the lead. For

example, in succession planning, the CEO drives

management succession at senior levels and serves as

counsel the board. The CEO’s role diminishes as a transition

nears, and the board moves toward selecting the

next CEO. To minimize confusion about the respective

roles of the board and CEO, it’s helpful to have an open

channel for communication. Effective use of executive

sessions is part of the answer. Regularly meeting in executive

session, both with and without the CEO, helps

reduce the awkwardness that can arise when the board

has executive sessions only on an as-needed basis.

When the board meets without the CEO, it is best practice

to debrief with the CEO immediately. The CEO evaluation

also provides an opportunity for the board to

assess aspects of the CEO’s performance — including

succession planning — that the board is ultimately

accountable for overseeing.

What is our board succession plan?

In the words of Vanguard’s McNabb, having the right

directors on the board “is the single most important

factor in good governance. … Who they are, how they

interact and the skills they bring to the table are critical

from a long-term value standpoint.” Boards should

continually consider whether they have the optimum

composition, given the company’s strategic direction

and the current business context. Boards should also

establish mechanisms to identify the expertise that will

be valuable as the context and strategy change. For

example, in an industry that is rapidly consolidating, a

board will want to consider whether it has the capability

it needs to best oversee multiple acquisitions or the

sale of the business in shareholders’ best interests. The

board of a company with a new first-time CEO may

decide it needs someone to serve in a mentoring

capacity to the CEO. Regularly reviewing the current

composition and any gaps positions the board to take

advantage of natural attrition from director departures

and retirements. The best boards also forge agreement

about the right degree of turnover and the mechanisms

to promote board refreshment, including appropriate

time frames.

What is our mechanism for evaluating the

contributions of individual directors and

providing director feedback?

On many boards, the elephant in the room is the performance

(or lack of) of an individual director. Consensus

is growing in support of conducting individual director

assessments as part of the board effectiveness assessment

— not to grade directors, but to provide constructive

feedback that can improve performance. It can be

difficult or uncomfortable to raise individual director

performance issues, but high-performing boards expect

directors to stay engaged and to contribute fully, and are

willing to address under-performance. They establish a

mechanism for surfacing and addressing issues and use

director succession planning to encourage healthy turnover

and accountability. They also create an environment

that encourages individual directors to think critically

about their contributions and the relevance of their skills

to the company strategy.

The 8 Biggest Contributors to

Board Dysfunction

1. Too much time spent on compliance and other

backward-looking reviews at the expense of strategy

2. Lack of trust between the board and CEO

3. Weak or non-existent CEO succession plan

4. Lack of board succession planning

5. Disruptive or disengaged directors

6. Poor decision-making processes

7. Lack of a direct channel to shareholders

8. Too much board information and material

What is our board culture and how does

it contribute to our ability to advise

management effectively?

A really good board understands its own culture and

how it impacts its decision-making and relationship

with management. Despite the growing appreciation

for the importance of culture, few directors are able to

describe their board culture beyond “collegial” or

“engaged.” A deeper understanding of the culture of

the board — how directors make decisions, handle

disagreements, share information and the spirit in

which they do these things — can improve the board’s

ability to advise management and provide appropriate

oversight. In a fast-moving, highly dynamic industry, for

example, the board needs to learn fast, remain open to

alternatives and needs at least some directors with a

more agile orientation. Culture can be shaped by influential

figures, such as the chair, the CEO, the founder

or long-serving directors; structural elements such as

the format and conduct of meetings; selection and

onboarding of new directors; or external events and the

board’s response to them. High-performing boards are

willing to examine their culture more closely and assess

its alignment with the needs of the business.

What processes are in place for engaging

with shareholders?

Management is responsible for communicating with

investors about the business, but shareholders increasingly

want to engage with the board on a range of

governance issues, including succession, compensation,

risk oversight and other concerns. Often, it’s not

until after a board has experienced a challenge from

shareholders — losing a say-on-pay vote, for example

— that it concludes it needs to improve communication

with shareholders. The most effective boards stay

abreast of how the company is perceived by investors.

They identify in advance who should take the lead from

the board (whether a committee or individual board

leader) in dialogue with shareholders and in

responding to investor inquiries. Robust relationships

with investors can help the board understand how the

company is viewed externally versus competitors and

can reduce the chance that the company will be

surprised by activists or proxy votes. And when challenges

do arise, the board is more likely to have built

up a reservoir of understanding and support among

large long-term shareholders.

Conclusion

The bar continues to rise for boards, which not only face

pressure from shareholders but also want to hold themselves

to higher standards of performance. Boards can use

robust board assessments to ensure that they measure up

to the evolving standards of corporate governance and

have the composition, practices and healthy dynamics to

be effective stewards of the business.